Our Commitment to

At Linzor, we are committed to responsible investing as an integral part of our business model.

Latin America offers ample opportunities to make a positive impact on the environment and on society while earning an attractive investment return. Our goal as investors is to allocate capital to businesses that not only have the potential to grow and become more valuable, but that can do so in a sustainable and socially responsible manner. We are convinced that by investing with responsibility and purpose, we are creating an additional value driver for our portfolios. Our efforts in this area have earned recognition from the Latin American private capital association and others in recent years.

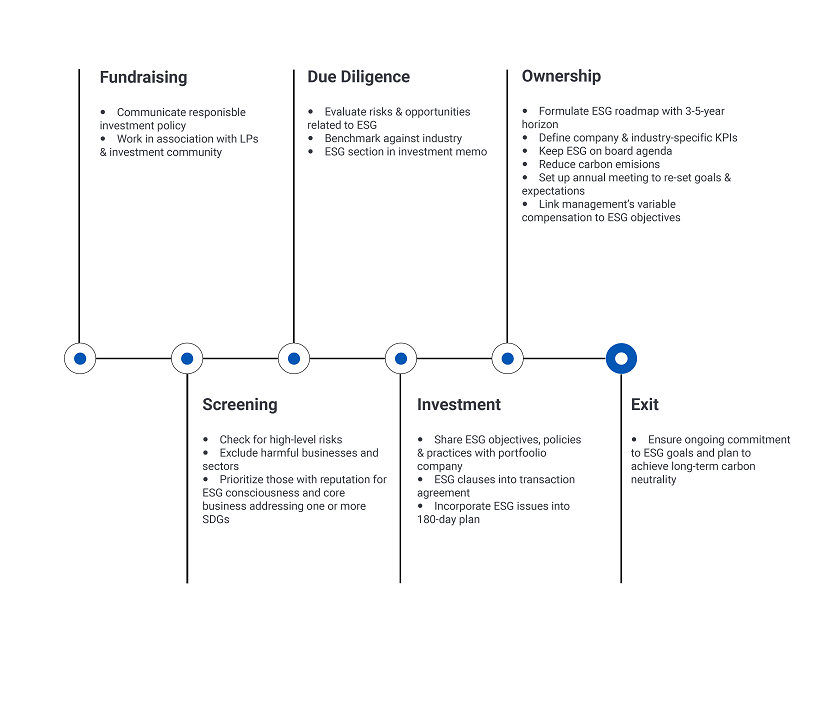

We actively consider environmental, social and governance (ESG) factors throughout the investment process.

At the screening stage, we filter prospective investments based on their exposure to industries or geographies deemed high risk or specific business practices considered unethical. During due diligence, we evaluate the ESG practices and societal impact of prospective investments to identify risks and opportunities within the company. This results in a roadmap for initiatives to be implemented if the investment materializes. The investment committee discusses ESG findings in depth and weighs them when making investment decisions. If significant red flags are found, we may choose to withdraw from a transaction. During ownership, the Linzor deal team establishes ESG and impact goals in collaboration with management and monitors day-to-day progress on ESG initiatives, while an ESG & Impact committee formed by in house and external executives reviews ESG & Impact plans and performance annually.

We are signatories of the Principles for Responsible Investment and use the Sustainable Development Goals as a framework for our ESG and impact targets.

We have been well-aligned with the principles of the PRI throughout the firm’s history given our investment approach, and became signatories in 2021. We have also developed an SDG impact thesis for each investment in our third fund, and plan to do so in subsequent funds as well. We track the evolution of a set of environmental, social, and governance indicators, including some that apply across the portfolio (on climate change and diversity, equity and inclusion), and others that are company-specific, and we report the results to our investors annually. In 2021, we participated in the PRI-sponsored Climate Initiative for Latin American Investors and became the first signatory in Latin America ex-Brazil of the Net Zero Asset Managers Initiative.

Our ESG measurement framework includes the following topics, with each indicator tied to specific Sustainable Development Goals:

![]()

Environmental

Energy consumption

Energy efficiency

Renewable energy use

Carbon footprint

Climate change awareness

Waste management

Supplier policy

![]()

Social

Job creation

Employee health & safety

Quality employment

Diversity

Non-discrimination

Profit-sharing

Community engagement

![]()

Governance

Board composition

Board committees

Audit and internal controls

CEO succession

Business integrity

Anti-bribery

Whistleblower channel

Risk management

![]()

Company-Specific

SME financing

Higher education payback and employability

Internet access in

underserved areas

Quality of care and

affordability in healthcare

Population coverage for

healthcare services

We care deeply about the impact of our investment activities on all stakeholders and take our responsibility as stewards of capital seriously.

Our responsible investment policies and practices are the product of our evolution as a firm. While we have always sought to instill the best practices in transparency, corporate responsibility, and ethics throughout our portfolio, today we are taking a more proactive and deeper approach that involves setting more ambitious ESG and impact targets. We are convinced that this will have a positive impact on our communities and environment, while enhancing the long-term value creation of our portfolio.

Read more about the award-winning ESG programs at some of our portfolio companies